Montana Life Group does not offer tax guidance. *Corporations with year end date of December 31, 2015 Important Tax Return and Extension Dates 2016 Whether filing taxes as a corporation or an individual, it’s always important to be mindful of identity theft tax scams. Partnerships, on the other hand, can request an automatic 5-month extension via Form 7004. Therefore, if a corporation’s year-end date is December 31, 2015, its tax deadline is March 15, 2016.Ĭorporations can also get a six-month extension of time to file by filing Form 7004 with the IRS. (Note, LLCs can opt to be taxed as corporations, in which case they would have deadlines discussed below.)Ī corporation’s deadline for filing its tax return (Form 1120, Form 1120A, and Form 1120S) is the 15th day of the third month after the corporation’s fiscal year. A multi-member LLC is taxed as a partnership as well, therefore it has an April 15 filing deadline. The same is true for a partnership tax return. Its tax return is due on the same day as the individual partners’ returns – April 15, 2016. A single-member LLC is taxed as a sole proprietorship, so its deadline is also April 15. Certain types of business entities are required to file tax returns or file tax extensions by March 15, 2016.Ī sole proprietorship is simply an extension of the individual running the business, so its tax return is due on the same date as the individual – April 15, 2016. The IRS has an online tax calendar for businesses that can be a helpful tool. We’ll address the tax filing deadlines for a sole proprietorship, partnerships, single-member LLCs, multiple-member LLCs, and corporations. The first step in figuring out the tax return filing deadline for your business is determining what type of business entity you have. Those who have already filed can check their refund status by visiting IRS.gov/Refunds.While April 15 is “ tax day” for individuals, if you own a business, your company might have a different filing deadline. For example, taxpayers can search the Interactive Tax Assistant, Tax Topics, Frequently Asked Questions, and Tax Trails to get answers to common questions. The IRS website offers a variety of online tools to help taxpayers answer common tax questions. Tax help is available 24 hours a day on IRS.gov.

Normal operations will resume when possible.

IRS live telephone assistance is currently unavailable due to COVID-19. The law requires taxpayers to properly address, mail and ensure the tax return is postmarked by the July 15, 2020, date. If taxpayers do not file a return within three years, the money becomes property of the U.S. The law provides a three-year window of opportunity to claim a refund. 2016 unclaimed refunds – deadline extended to July 15įor 2016 tax returns, the normal April 15 deadline to claim a refund has also been extended to July 15, 2020. This means that any individual or corporation that has a quarterly estimated tax payment due on or after April 1, 2020, and before July 15, 2020, can wait until July 15 to make that payment, without penalty. Estimated Tax Paymentsīesides the April 15 estimated tax payment previously extended, today’s notice also extends relief to estimated tax payments due June 15, 2020. Taxpayers requesting additional time to file should estimate their tax liability and pay any taxes owed by the July 15, 2020, deadline to avoid additional interest and penalties. An extension to file is not an extension to pay any taxes owed. Businesses who need additional time must file Form 7004.

Deadline to file extension 2016 corporate tax return software#

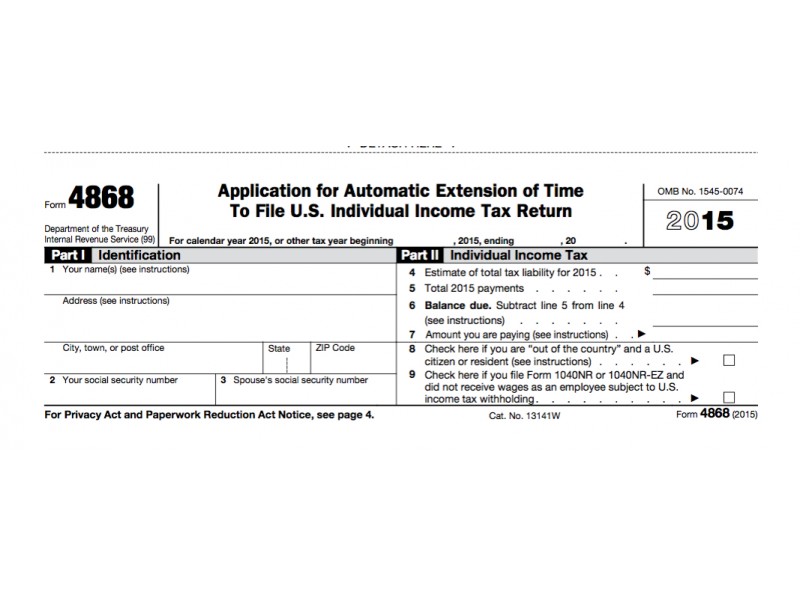

15, 2020, by filing Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov.

Individual taxpayers who need additional time to file beyond the July 15 deadline can request an extension to Oct. This means that anyone, including Americans who live and work abroad, can now wait until July 15 to file their 2019 federal income tax return and pay any tax due. Individuals, trusts, estates, corporations and other non-corporate tax filers qualify for the extra time. As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after April 1, 2020, and before July 15, 2020. Today’s notice expands this relief to additional returns, tax payments and other actions. No late-filing penalty, late-payment penalty or interest will be due. Last month, the IRS announced that taxpayers generally have until July 15, 2020, to file and pay federal income taxes originally due on April 15. WASHINGTON - To help taxpayers, the Department of Treasury and the Internal Revenue Service announced today that Notice 2020-23 PDF extends additional key tax deadlines for individuals and businesses.

0 kommentar(er)

0 kommentar(er)